Resources for Financial Wellbeing

Get your free retirement report.

Click below to answer a few questions and get your personalised, no-strings-attached retirement report.

Explore our news and insights on financial advice including IHTs, green investing, and more.

Guide: The money lessons your family could learn from board games this Christmas

As you sit down to play a board game with your family over the festive period, you might pick one containing valuable money lessons. From the importance of diversifying in Risk to deciding upon goals in The Game of Life, there are plenty of learning opportunities.

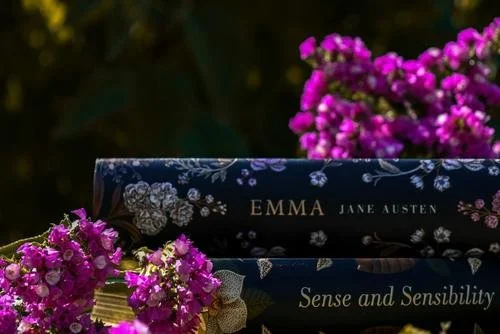

Guide: 5 enduring money lessons you can discover in Jane Austen’s novels

In life, the finest wisdom often comes from the most unexpected places. You might even discover financial insights in the pages of Jane Austen’s novels. Read this useful guide to uncover enduring lessons in Northanger Abbey, Pride and Prejudice, and other works by the celebrated author.

Investment market update: October 2025

Markets reached record highs in October 2025 despite ongoing uncertainty and disappointing economic data in some regions. Find out what may have affected the performance of your investments.

The difficult but important estate planning conversations to have with your family

Once you’ve created an estate plan, you might want to talk to your family about the decisions you’ve made. While these conversations can be difficult, they’re important and could ensure everyone is on the same page.

3 valuable ways to create a guaranteed income in retirement

Almost two-fifths of people say a guaranteed income is a priority in retirement. If you’d like the certainty of knowing how much you’ll receive each month, read about three valuable ways to create financial security when you stop working.

Pension v Lifetime ISA: What’s the best way to save for your retirement?

Both a pension and a Lifetime ISA can help you save for retirement, but they come with their own features. Here are the benefits and considerations of each.

Why successful investing starts with your mindset, not the markets

What’s the most important factor affecting the performance of your investments? Your mind might jump to the ups and downs of the market. However, the markets aren’t the starting point of a successful investment: your mindset is.

How you could use framing bias to your advantage

How information is framed can alter your view and influence your decisions. Thinking about how you approach financial choices could help you reframe them to improve your mindset, and lead to better outcomes.

Your Autumn Budget update, and what it means for you

The chancellor has delivered the government’s Autumn Budget. Here’s a summary of the key announcements and what they could mean for your financial plan

Guide: Everything you need to know about the State Pension

The State Pension often provides a reliable income in retirement that’s an important part of your overall financial plan. Yet, many people don’t understand how the State Pension works or what they’re entitled to. This useful guide covers the essentials you need to know, from when you can claim the State Pension to how the income it provides will increase each year.

Investment market update: July 2025

The US struck trade deals with several countries in July 2025, leading to markets rising and putting an end to some of the uncertainty that had plagued investors for months. Find out what else may have affected your investments recently.

4 methods for tax-efficiently supporting charities

Supporting a good cause could increase your wellbeing and, in some cases, it could make sense from a tax perspective too. So, if you want to donate to charitable causes, find out some of the ways you could do so efficiently.

Think cash is king? It might be time to review your mantra

There’s a certain comfort in holding cash savings. However, looking at a wider range of options and investments could help you see higher returns. Find out why.

Does your income make you a “Henry”? Here are some ways it could affect tax considerations

High earners striving to build wealth, dubbed “Henrys”, may find their tax position changes drastically as their income grows. Find out more about four key tax considerations that could be important for your long-term finances.

The decumulation dilemmas you might need to overcome when you retire

Retirement is an exciting milestone but decumulation could present some challenges, such as changing your mindset and ensuring you don’t run out of money during your lifetime. Find out more about decumulation dilemmas and how a financial plan could help you manage them.

How to remain calm amid Autumn Budget speculation

The Autumn Budget is still weeks away, but there’s plenty of speculation about what will be included in the news. While it can feel tempting to respond to attention-grabbing headlines, it might lead to decisions that aren’t right for you or don’t align with your long-term financial plan.

5 shrewd ways to avoid paying tax on your savings

Did you know the interest your savings earn could be taxed? As tax thresholds are frozen and interest rates are rising, more savers are set to be hit by an unexpected tax bill. Find out when your savings could be taxed and how you might reduce your liability.

Why the best legacy could be passing on your financial wisdom

Many people consider what they’ll leave behind for loved ones and how it could help them be more financially secure. While passing on assets provides a welcome helping hand, sharing your financial wisdom and encouraging your loved ones to think about the future could be just as important.

4 useful insights from a decade of Pension Freedoms

A decade ago, retirees were given more ways to access their savings thanks to the introduction of Pension Freedoms. While many people welcomed the greater flexibility, data suggests it’s come with challenges too. Discover some insights that may help you make informed pension decisions.